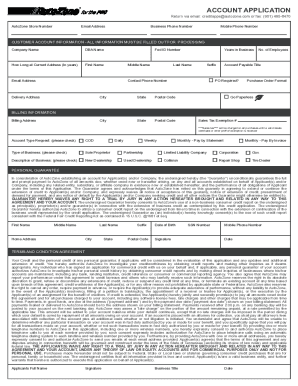

AutoZone Business Credit Application free printable template

Show details

9. UNAUTHORIZED USE You may be liable for any unauthorized use of your Account until you notify us in writing at AutoZone Commercial Credit P. Applicant will be contacted if such is required. AutoZone may require additional information from Applicant Guarantor or other parties in order to process this Application. By signing below Applicant Guarantor and except with respect to government agencies and not-forprofit each individual signing on behalf of Applicant authorizes AutoZone to provide...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign autozone credit application form

Edit your autozone account application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your autozone commercial account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing autozone application pdf online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit does autozone have a credit card form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out autozone credit card application form

How to fill out AutoZone Business Credit Application

01

Obtain the AutoZone Business Credit Application form from the AutoZone website or local store.

02

Fill in your business details, including the legal business name and the type of business.

03

Provide your business's physical address, mailing address (if different), and contact information.

04

Enter your federal tax identification number (EIN) or Social Security number if you are a sole proprietor.

05

Specify the type of business structure (e.g., corporation, partnership, sole proprietorship).

06

List the owners or officers of the business along with their personal information.

07

Provide banking information, including the name of the bank and the account number.

08

Complete the trade references section with contact information of suppliers you have established credit with.

09

Review the application for accuracy and completeness.

10

Sign and date the application to authorize AutoZone to review your credit.

11

Submit the application online or in person at your local AutoZone store.

Who needs AutoZone Business Credit Application?

01

Businesses that frequently purchase automotive parts and supplies and want to take advantage of credit terms from AutoZone.

02

Small business owners looking to manage cash flow while purchasing necessary products.

03

Fleet operators or companies in the automotive industry that require regular supplies and prefer to utilize a business credit account.

Fill

autozone credit application online

: Try Risk Free

What is application form of autozone?

There is no printable job application form of AutoZone.

People Also Ask about autozone net 30

Does AutoZone merchandise credit expire?

Abridged terms and conditions: AutoZone gift card never expires and does not have any dormancy fees. Not redeemable for: AutoZone Rewards Credits and AutoZone Gift Cards can't be used for orders that are Pick Up In-Store and Same Day Delivery.

Does AutoZone have tap to pay?

Does AutoZone accept contactless payments? Yes!

Can I get a credit card from AutoZone?

when you offer 6 and 12 Months Promotional Financing* to help customers manage purchases of $199-$749.99 (6 Months) or $750 or more (12 Months). by offering a dedicated credit card that customers can use at your business today and for their future auto needs.

Can you return electrical parts to AutoZone?

To return a product to an AutoZone store, return an item in its original condition and packaging, with receipt, within 90 days of the purchase date to request a refund. Return a defective item within the warranty period. Requests for refunds may be denied if the item has been used or installed.

Does AutoZone offer credit card?

BUILD CUSTOMER RELATIONSHIPS by offering a dedicated credit card that customers can use at your business today and for their future auto needs.

Can I use my synchrony card at a dealership?

Editorial and user-generated content is not provided, reviewed or endorsed by any company. No, you cannot use your Synchrony Car Care™ Credit Card everywhere. You can only use it at certain gas stations, auto parts and service merchants nationwide.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit autozone application from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including auto zone credit card, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send autozone commercial application to be eSigned by others?

When your apply for autozone credit card online is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit autozone commercial account application on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share autozone credit card apply from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is AutoZone Business Credit Application?

The AutoZone Business Credit Application is a form that businesses complete to apply for credit with AutoZone, allowing them to purchase auto parts and supplies on credit terms.

Who is required to file AutoZone Business Credit Application?

Businesses that wish to establish a credit account with AutoZone need to file the AutoZone Business Credit Application.

How to fill out AutoZone Business Credit Application?

To fill out the AutoZone Business Credit Application, businesses need to provide their legal business name, address, contact information, and financial details, along with personal identification of the owner's or authorized individuals.

What is the purpose of AutoZone Business Credit Application?

The purpose of the AutoZone Business Credit Application is to assess the creditworthiness of a business applicant and to establish credit terms for purchasing auto parts and services.

What information must be reported on AutoZone Business Credit Application?

The AutoZone Business Credit Application requires reporting of information such as the business's legal name, address, tax identification number, bank references, trade references, and personal guarantees from business owners.

Fill out your AutoZone Business Credit Application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Autozone Business Account Application is not the form you're looking for?Search for another form here.

Keywords relevant to autozone business account

Related to apply for autozone credit card

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.